SOUTH FLORIDA

Home Sales Down, Average Price Up

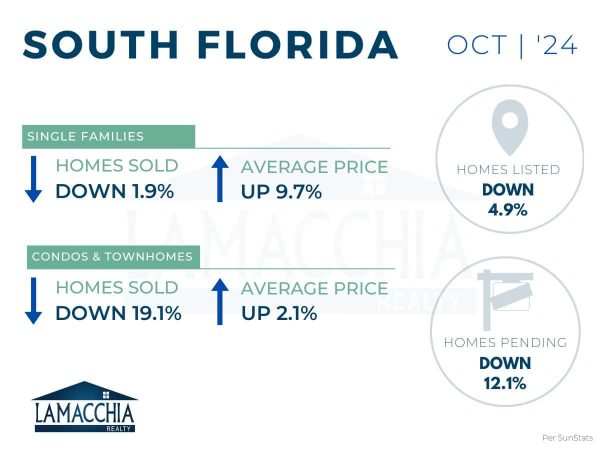

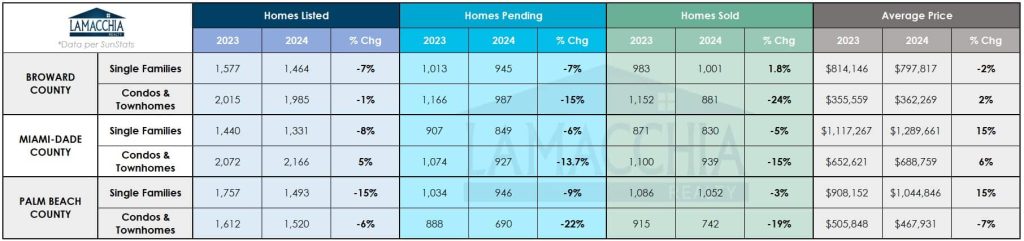

Home sales are down 10.8% year over year, with October 2024 at 5,445 compared to 6,107 last October. Sales are down across all categories.

- Single families: 2,940 (2023) | 2,883 (2024)

- Condos & Townhomes: 3,167 (2023) | 2,562 (2024)

Average sale price increased 10.4% year-over-year, now at $786,373 compared to $712,312 in October 2023. Prices increased across all categories.

- Single families: $938,694 (2023) | $1,029,557 (2024)

- Condos & Townhomes: $502,158 (2023) | $512,720 (2024)

Homes Listed For Sale in South Florida:

The number of homes listed is dopwn by 4.9% when compared to October 2023.

- 2024: 9,959

- 2023: 10,473

- 2022: 9,184

Pending Home Sales in South Florida:

The number of homes placed under contract is down by 12.1% when compared to October 2023.

- 2024: 5,344

- 2023: 6,082

- 2022: 5,982

Market data provided by SunStats then compared to the prior year.

What’s Happening in the South Florida Market?

- Nationally, existing home sales rose 3.4% in October to an annual rate of 3.96 million, marking the first year-over-year increase in 37 months since July 2021. Despite the national housing market trends for the month, South Florida saw a decrease in home sales when compared to this time last year.

- According to Mortgage Daily News, mortgage rates in October began at approximately 6.2% and steadily rose to around 7% by month’s end. Despite the rise, rates are still lower than the 7.9% recorded during the same time last year, showing some year-over-year improvement.

- The drop in total sales and pending transactions indicates that buyer demand continues to slow. Recent regulatory changes for townhomes and condos have led to higher costs for current owners, pushing many of these properties beyond the budget of potential buyers.

- Florida’s new flood disclosure law, which took effect on October 1, 2024, requires sellers to share any flood damage history. This may be causing some sellers to hold off on listing their homes, especially if they’ve had flood issues in the past. As buyers become more cautious about flood risks, fewer homes are being put on the market.

As we navigate the adjusting market and the impact it’s having on buying, selling, renting, and homeownership, being informed is one of the first steps in knowing what to do next. Click on the button to visit the South Florida Real Estate Updates page and never hesitate to contact us with questions.

Instant Home Evaluation

Additional Resources

October 2024 South Florida Housing Report

SOUTH FLORIDA Home Sales Down, Average Price Up Home sales are down 10.8% year over year, with October 2024 at 5,445 compared to 6,107 last

October 2024 South Florida Housing Report

SOUTH FLORIDA Home Sales Down, Average Price Up Home sales are down 10.8% year over year, with October 2024 at 5,445 compared to 6,107 last